Your credit score is the single most effective indicator of how well you are managing your debt. Bad credit can be embarrassing and stressful. You may encounter debt collectors, repossession of vehicles, foreclosure of your property, and higher fees and interest rates.

Unpaid debts will lower your credit rating, damage your credit history and may prevent you from obtaining further credit. Improving your credit score raises your debt profile, and your ability to borrow, especially when you need it most.

What Is A Credit Score?

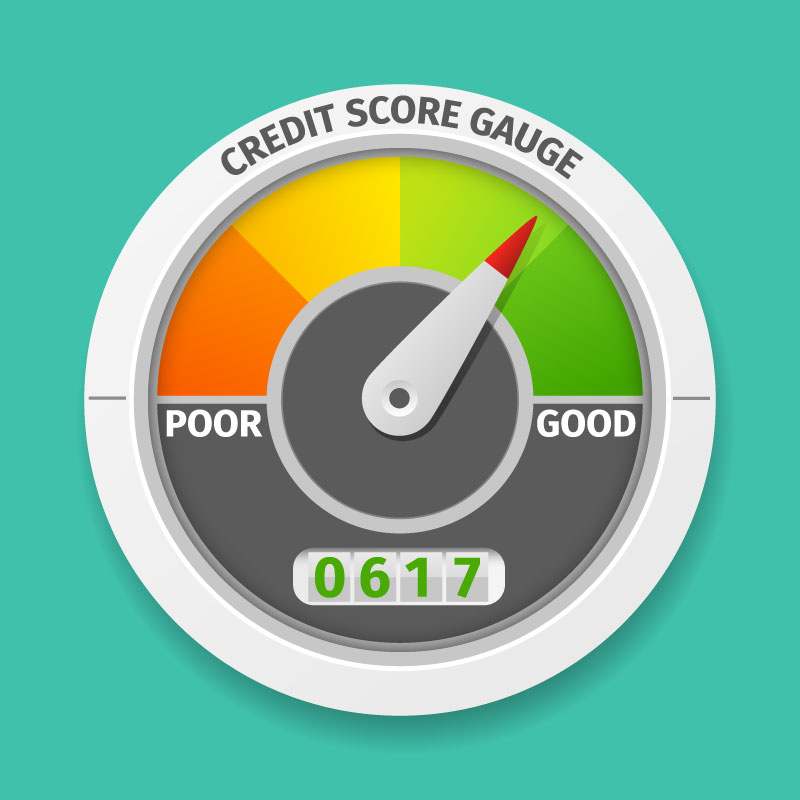

Before we begin, it’s important to understand what is involved in having a credit score. Your credit score is a digital score, comprising three numbers. It is used by most lending agencies you may contact to apply for credit.

It considers your overall loan profile, including all personal debt and other credit facilities. Debts include student loans, insurance premiums, utility bills, mortgages, vehicle loans, rents, leases, and other monthly commitments.

The score is to assess your suitability to obtain credit. It is primarily based on how well you service all debts over a stipulated period.

Your creditors compile a credit profile and share this information with affiliated entities in evaluating how well you repay loans.

It creates a credit history which includes your total debts. They record the repayment periods of each debt, the types of debt, and how you are managing.

Credit scores usually range between 300 and 900 points. The scores may increase or decrease depending on how early or late you make repayments.

A good credit score will help you access funding for your home, business, vehicle, or education.

Improving your credit score involves the following:

Paying Your Bills on Time

Paying your bills when they become due is an effective way of maintaining a good credit score. They will help to reduce your overall credit rating.

Even if you make the minimum payment only, make sure it falls within the billing due date. Late payments will decrease your overall credit score.

You will also avoid hefty late fees and accumulating interest charges for late payments.

Managing Credit Cards Carefully

Studies show that credit card debt is a universal headache if the debt is not managed properly. Owning a credit card is one of the prerequisites to help build good credit.

However, while credit cards may be easy to obtain, they attract very high-interest rates. Acquiring credit cards with lower or zero interest rates may be more manageable if you can obtain such.

They will help you pay off balances easier with no additional interest charges. While using credit cards, keep your spending to no more than 30 percent of your total credit limit.

Managing Multiple Credit Cards Are Also Essential:

1. Use the card with the highest interest rates sparingly or for emergencies only.

2. Clear the lower cards’ balance first and contribute these free funds to the cards with the higher balances.

3. Communicate with your creditors if you are experiencing any changes in your finances to re-negotiate terms if possible.

4. Stay within minimum payments on your credit cards to help keep your credit rating trustworthy.

5. Use only those funds on your credit card that you can pay off comfortably in a lump sum.

Keeping Unused Credit Cards Open

Closing old credit card balances that are written off may also hurt your credit scores. If you close it at this point, your creditors may see it as ‘new’ debt.

If you are not receiving any charges on the account, keeping it open will help reduce your debt to equity ratios.

Make Early Payments

Early payments will also help lenders assess your capacity to handle any future loans. They demonstrate to your creditors you are serious about handling your commitments. It will also reduce the incidence of filing for bankruptcy or other unpleasant debt recovery measures.

Making Extra Payments When You Can

Paying down your loans early is a good way to keep your credit profile healthy.

Make extra payments within your regular billing cycle when you can. Additional payments can enhance your score and reduce your debt ratios.

Checking Your Credit Reports Periodically

Removing any errors on your credit scores will help improve your ratings dramatically.

Some studies show there is a small percentage of customers who have mistakes on their annual credit reports.

Areas like the wrong mailing address, errors in spelling your name, or fraudulent activities may all influence your credit rating.

Request a yearly credit report and check for any errors. Call your local creditors or credit bureaus and discuss your findings to help reduce your scores.

Limiting New Credit Commitments

That incredible new deal may sound fantastic but may hurt your credit scores in the long run.

Opening multiple new accounts in a short space of time may damage your financial credibility. It may suggest you are not financially mature.

Controlling “Bounced’ Checks

Ensure you have enough funds to offset any checks you may write on your bank account.

Insufficient funds in your bank account, resulting in returned checks will also affect your credit scores.

Returned checks will decrease your credit rating if your bankers report their findings to the local credit bureau.

Maintaining A Personal Loan File

Keeping track of debt can be daunting, but a good reminder system can help you stay on track.

Set up a file of all your debts. Record the payment amounts, the length of the loan period, the dates they are due, and any interest charges.

It will help you schedule payments and stay within your limits without over-extending yourself.

Wrap Up

A good credit score is essential in obtaining and maintaining credit when needed. It informs your creditors that you are capable of managing your financial affairs. It is important to understand your credit score and how it influences lenders to trust you with their money.

Poor credit scores will affect your ability to attract future loans and financing for important financial decisions. Late payments, bankruptcy, and other bad debts decrease your scores and limit and future borrowing.

Minimizing bad debt will help to raise your credit scores while engendering confidence in your ability to service your debts.